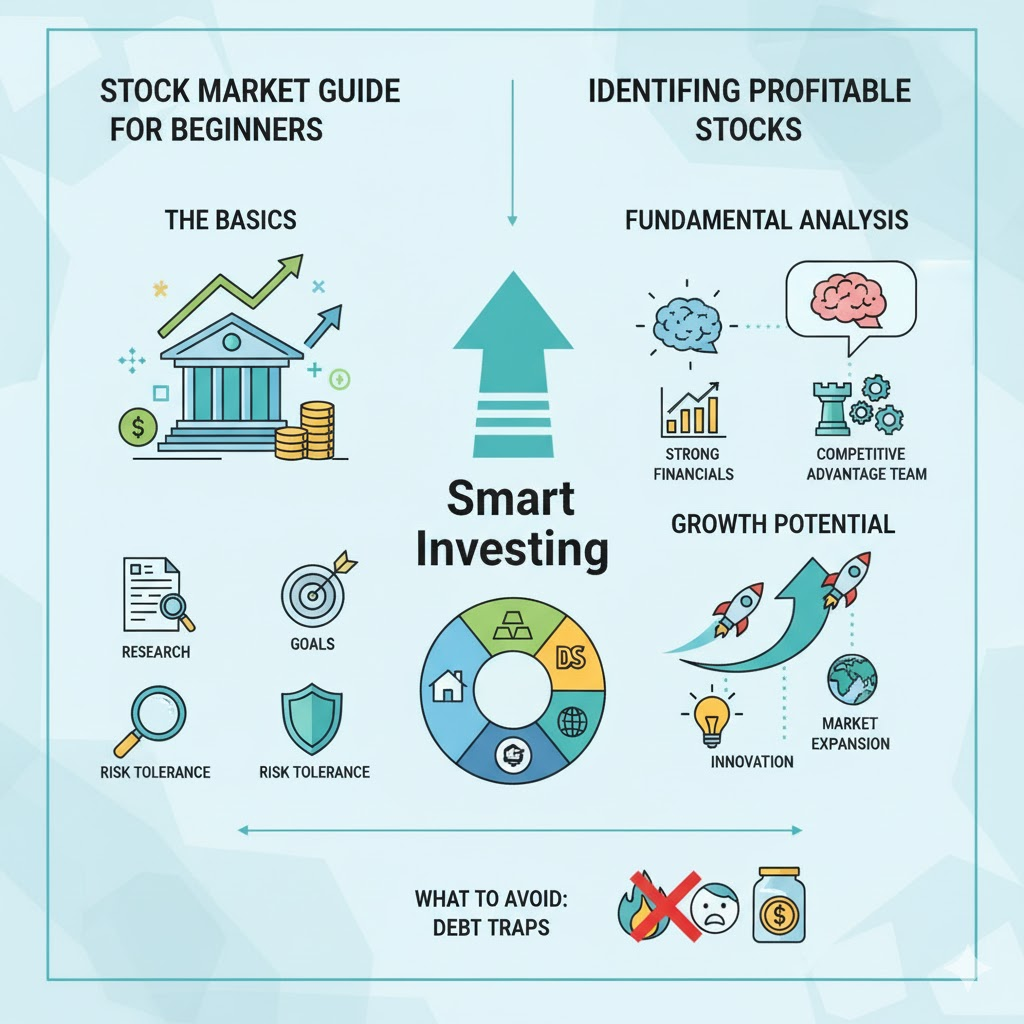

The stock market can seem like a complex, intimidating world, full of jargon and high-stakes decisions. However, with the right knowledge and a disciplined approach, it’s one of the most powerful avenues for wealth creation. This guide will demystify the basics for newcomers and offer insights into identifying potentially profitable stocks.

The Very Basics: What is the Stock Market?

At its core, the stock market is simply a place where shares of publicly traded companies are bought and sold. When you buy a stock (or “share”), you’re buying a tiny piece of ownership in that company.

- Why companies issue stock: To raise capital to grow their business.

- Why people buy stock: To potentially profit from the company’s growth (through increased stock price) and sometimes through dividends (a portion of the company’s profits paid to shareholders).

Key Terms for Beginners

- Stock Exchange: A marketplace where stocks are traded (e.g., New York Stock Exchange – NYSE, NASDAQ).

- Share Price: The current market value of one share of a company’s stock.

- Market Capitalization (Market Cap): The total value of a company’s outstanding shares (Share Price x Number of Shares). It indicates a company’s size.

- Dividend: A payment made by a company to its shareholders, usually out of its profits. Not all companies pay dividends.

- Portfolio: The collection of all the investments an individual or institution holds.

- Diversification: Spreading your investments across different types of assets, industries, and geographies to reduce risk.

- Brokerage Account: An investment account you open with a brokerage firm (e.g., Charles Schwab, Fidelity, Robinhood) to buy and sell stocks.

Getting Started: Your First Steps

- Educate Yourself: You’re doing it right now! Read books, articles, and take online courses. Understand fundamental concepts before risking real money.

- Define Your Goals: Why are you investing? For retirement, a down payment, or long-term growth? Your goals will influence your investment strategy.

- Determine Your Risk Tolerance: How much fluctuation in your investment value can you comfortably handle? This will guide your choice of stocks.

- Open a Brokerage Account: Research reputable brokerage firms. Many offer commission-free trading.

- Start Small: Don’t invest all your money at once. Begin with an amount you’re comfortable losing, as all investments carry risk. Consider investing through ETFs (Exchange-Traded Funds) or Mutual Funds initially, as they offer immediate diversification.

How to Identify Potentially Profitable Stocks

While there’s no foolproof method, here’s a simplified approach to identifying stocks with good potential:

1. Fundamental Analysis: Look at the Company’s Health

This involves evaluating a company’s intrinsic value by examining its financial statements and economic factors.

- Strong Financials:

- Revenue Growth: Is the company’s sales consistently increasing?

- Profitability: Is it making money (Net Income)? Look at Earnings Per Share (EPS).

- Debt Levels: Does it have manageable debt? Too much debt can be risky.

- Cash Flow: Is it generating healthy cash flow from operations?

- Competitive Advantage (Moat): What makes the company unique and hard to replicate? (e.g., strong brand, patents, network effects, cost advantage).

- Management Team: Is the leadership experienced, ethical, and forward-thinking?

- Industry Outlook: Is the industry the company operates in growing or declining?

- Valuation: Even a great company can be a bad investment if its stock price is too high. Common valuation metrics include:

- P/E Ratio (Price-to-Earnings): Share price divided by EPS. A lower P/E relative to its industry often suggests it might be undervalued.

- PEG Ratio (Price/Earnings to Growth): P/E divided by earnings growth rate. A PEG of 1 or less can indicate good value for growth stocks.

2. Growth Potential

- Innovation: Is the company innovating and creating new products or services?

- Market Expansion: Is it expanding into new markets or acquiring competitors?

- Strong Demand: Is there growing demand for its products/services?

3. Technical Analysis (Optional, for more advanced traders)

This involves studying past market data, primarily price and volume charts, to identify patterns and predict future price movements. Beginners should focus on fundamentals first.

What to Avoid (Debt Traps of the Stock Market)

- “Hot Tips”: Never invest based solely on rumors or advice from unverified sources. Do your own research.

- Emotional Decisions: Don’t buy out of FOMO (Fear Of Missing Out) or sell out of panic. Stick to your strategy.

- Lack of Diversification: Putting all your money into one stock is extremely risky. Diversify your portfolio.

- Short-Term Mindset: For most beginners, a long-term investment horizon (5+ years) is best. Trying to “time the market” short-term is incredibly difficult.

- Investing Borrowed Money: Never invest money you cannot afford to lose, especially not borrowed money.

Conclusion

The stock market offers incredible opportunities for long-term growth. Start by educating yourself, understanding your financial goals and risk tolerance, and then making informed, disciplined decisions. Focus on fundamental analysis to identify solid companies, diversify your portfolio, and remember that patience and a long-term perspective are your greatest assets. Happy investing!