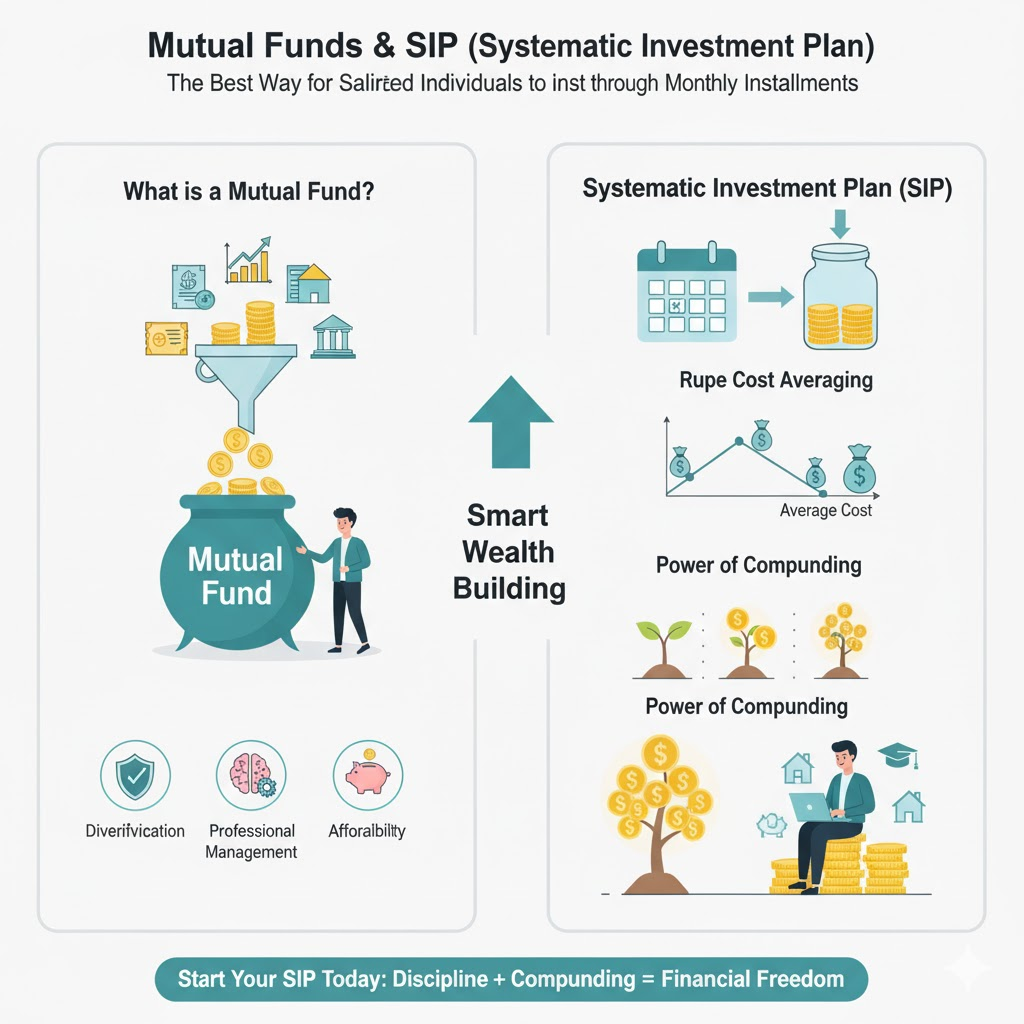

For salaried individuals, consistently growing wealth can seem challenging amidst monthly expenses and financial commitments. However, there’s a powerful and accessible investment strategy that stands out for its simplicity, discipline, and potential for long-term growth: Mutual Funds combined with a Systematic Investment Plan (SIP). This duo offers an ideal way to invest through manageable monthly installments, making wealth creation accessible to everyone, regardless of their income level.

What is a Mutual Fund?

A Mutual Fund is a professionally managed investment fund that pools money from many investors to purchase securities like stocks, bonds, money market instruments, and other assets. The fund manager, an expert in the field, invests this collective money according to a predefined investment objective.

- Diversification: Instead of buying single stocks, a mutual fund allows you to own a small piece of many different companies or assets, instantly diversifying your portfolio and reducing risk.

- Professional Management: Experienced fund managers make the investment decisions for you, saving you time and the need for in-depth market research.

- Affordability: You can invest in a diverse portfolio with relatively small amounts of money.

- Liquidity: Most mutual funds allow you to redeem your investments easily.

Types of Mutual Funds (Common for Salaried Individuals):

- Equity Funds: Invest primarily in stocks. Offer higher growth potential but come with higher risk. Ideal for long-term goals (5+ years).

- Debt Funds: Invest in fixed-income securities like bonds and government securities. Less volatile than equity funds, suitable for short to medium-term goals or as a lower-risk component of a portfolio.

- Hybrid Funds (Balanced Funds): Invest in both stocks and bonds, aiming to balance growth and stability.

- Index Funds/ETFs: Track a specific market index (e.g., S&P 500). Offer broad market exposure with lower fees due to passive management.

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) is a method of investing in mutual funds by making regular, fixed payments (e.g., monthly, quarterly) over a period of time. It’s like a recurring deposit for investments.

Key Benefits of SIPs for Salaried Individuals:

- Discipline & Automation: SIPs instill financial discipline. Once set up, the fixed amount is automatically debited from your bank account, ensuring consistent investment without manual effort.

- Rupee Cost Averaging: This is a powerful benefit. When you invest a fixed amount regularly, you buy more units when the market price is low and fewer units when the market price is high. Over time, this averages out your purchase cost, reducing the impact of market volatility.

- Power of Compounding: By investing regularly over a long period, your returns start earning returns themselves. This compounding effect can lead to substantial wealth creation, even from small monthly contributions.

- Example: Investing $100/month for 20 years at an assumed 10% annual return could grow to over $75,000, with only $24,000 of your own money invested.

- Affordability & Flexibility: SIPs allow you to start investing with amounts as low as $500 or even $100 per month, making it accessible even with a limited budget. You can also increase, decrease, pause, or stop your SIP payments as per your financial situation.

- Achieve Financial Goals: Whether it’s saving for a down payment, a child’s education, or retirement, SIPs provide a structured way to consistently work towards your long-term financial objectives.

The Best Way to Invest through SIPs for Salaried Individuals

- Define Your Financial Goals: Clearly identify what you are saving for (e.g., retirement in 25 years, car in 3 years). Your goals will dictate the type of mutual fund.

- Determine Your Risk Tolerance: If you’re comfortable with market fluctuations for higher returns, equity funds might suit you. If you prefer stability, debt or hybrid funds could be better.

- Research & Select Mutual Funds: Look for funds with a consistent track record, experienced fund managers, and reasonable expense ratios (annual fees).

- For long-term growth, consider Diversified Equity Funds or Index Funds.

- For shorter-term goals or less risk, look at Debt Funds or Hybrid Funds.

- Start a SIP: Most banks and online investment platforms make it very easy to set up an SIP. Choose your monthly investment amount and the date.

- Be Consistent & Patient: The real magic of SIP and compounding happens over time. Avoid reacting to short-term market ups and downs. Stick to your plan.

- Regular Review: Annually review your portfolio and SIP contributions. Adjust them if your financial goals, risk tolerance, or income changes.

Conclusion

For salaried individuals, mutual funds combined with a Systematic Investment Plan offer an ideal, disciplined, and effective pathway to building long-term wealth. By leveraging the power of diversification, professional management, rupee cost averaging, and compounding, you can transform small monthly contributions into a substantial corpus, securing your financial future and achieving your dreams. Start your SIP today, and let time and consistency work wonders for your money.