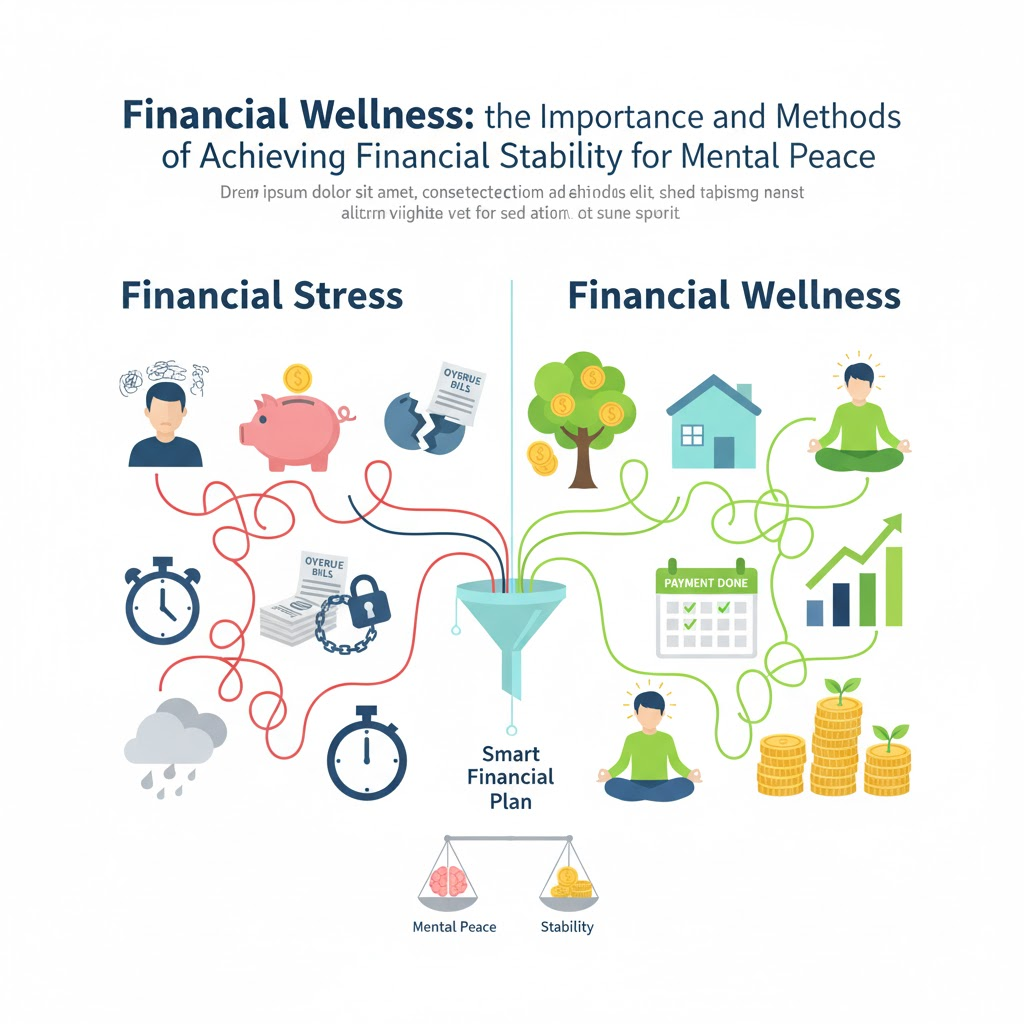

In our busy lives, we often prioritize physical and mental health, but tend to overlook a critical pillar of overall well-being: financial wellness. Financial stress is a leading cause of anxiety, relationship issues, and poor physical health. Achieving financial stability isn’t just about having money; it’s about having the peace of mind that comes from managing your finances effectively and feeling secure about your future.

What is Financial Wellness?

Financial wellness is a holistic state of your financial life. It means:

- Having control over your day-to-day finances.

- Being able to absorb a financial shock (like an unexpected expense).

- Being on track to meet your financial goals (retirement, buying a home, education).

- Making informed financial decisions.

- Feeling confident and secure about your financial future.

It’s not about being rich, but about being financially healthy and stable, which directly contributes to your mental peace.

The Importance of Financial Wellness for Mental Peace

The connection between money and mental health is undeniable.

- Reduces Stress & Anxiety: Knowing your bills are covered, you have savings for emergencies, and you’re working towards your goals significantly reduces daily worry.

- Improves Relationships: Financial disputes are a common cause of conflict in relationships. Shared financial wellness fosters trust and harmony.

- Boosts Self-Esteem & Confidence: Taking control of your finances empowers you and reinforces a sense of accomplishment.

- Enhances Physical Health: Chronic financial stress can lead to health issues like high blood pressure, sleep disturbances, and a weakened immune system. Achieving financial stability can alleviate these physical symptoms.

- Provides Freedom & Choice: Financial well-being opens up opportunities – whether it’s pursuing a passion, taking a career break, or simply enjoying life without constant money worries.

Methods of Achieving Financial Stability and Mental Peace

Achieving financial wellness is a journey, not a destination. Here are actionable steps you can take:

1. Understand Your Current Financial Situation

- Track Your Spending: Use apps or spreadsheets to know exactly where your money goes. Awareness is the first step to control.

- Calculate Your Net Worth: Add up all your assets (savings, investments, property) and subtract your liabilities (debts). This gives you a snapshot of your financial health.

2. Create and Stick to a Budget

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Give every dollar a job, ensuring no money is unaccounted for.

- Automate It: Set up automatic transfers for savings and bill payments so you don’t have to think about them.

3. Build an Emergency Fund

- Aim to save 3-6 months’ worth of essential living expenses in an easily accessible savings account. This acts as a crucial buffer against unexpected job loss, medical emergencies, or other financial shocks.

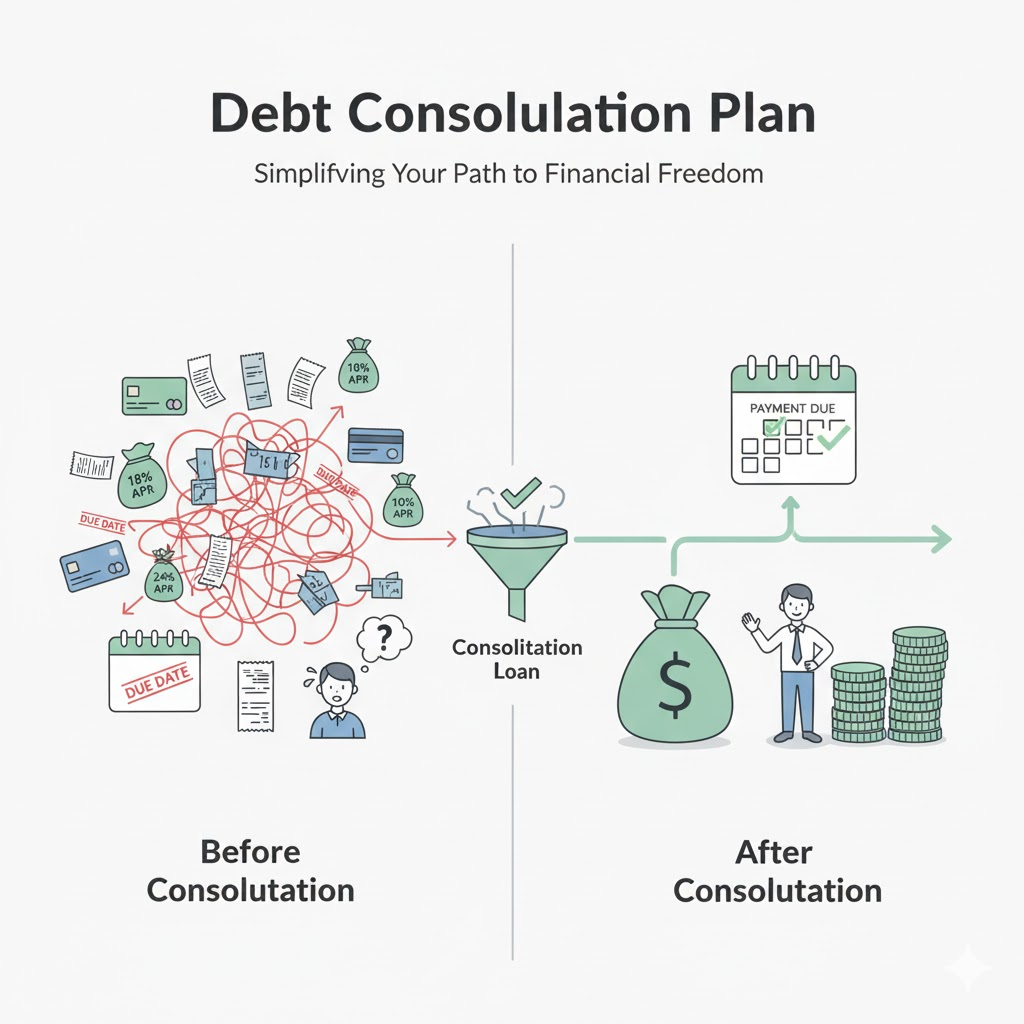

4. Tackle High-Interest Debt

- Prioritize paying off high-interest debts (like credit card balances). The interest you pay on these debts drains your resources and creates persistent stress. Consider strategies like the debt avalanche or debt snowball method.

5. Set Clear Financial Goals

- Define what financial stability means to you. Do you want to buy a house? Retire early? Pay for your child’s education?

- Break down large goals into smaller, achievable steps with specific timelines.

6. Invest for the Future

- Once you have an emergency fund and are managing high-interest debt, start investing. Even small, consistent contributions can grow significantly over time thanks to compounding.

- Utilize retirement accounts like 401(k)s or IRAs, especially if your employer offers matching contributions.

7. Educate Yourself Continuously

- Read books, listen to podcasts, follow reputable financial blogs. The more you understand about personal finance, the more confident you’ll feel making decisions.

8. Practice Mindful Spending

- Before making a purchase, pause and consider if it aligns with your values and budget. Differentiate between needs and wants.

- Avoid “lifestyle creep,” where your spending increases disproportionately with your income.

Conclusion

Financial wellness isn’t a luxury; it’s a necessity for a balanced and peaceful life. By taking proactive steps to understand, manage, and grow your finances, you’re not just securing your future; you’re investing in your present mental peace and overall well-being. Start small, stay consistent, and celebrate your progress along the way.