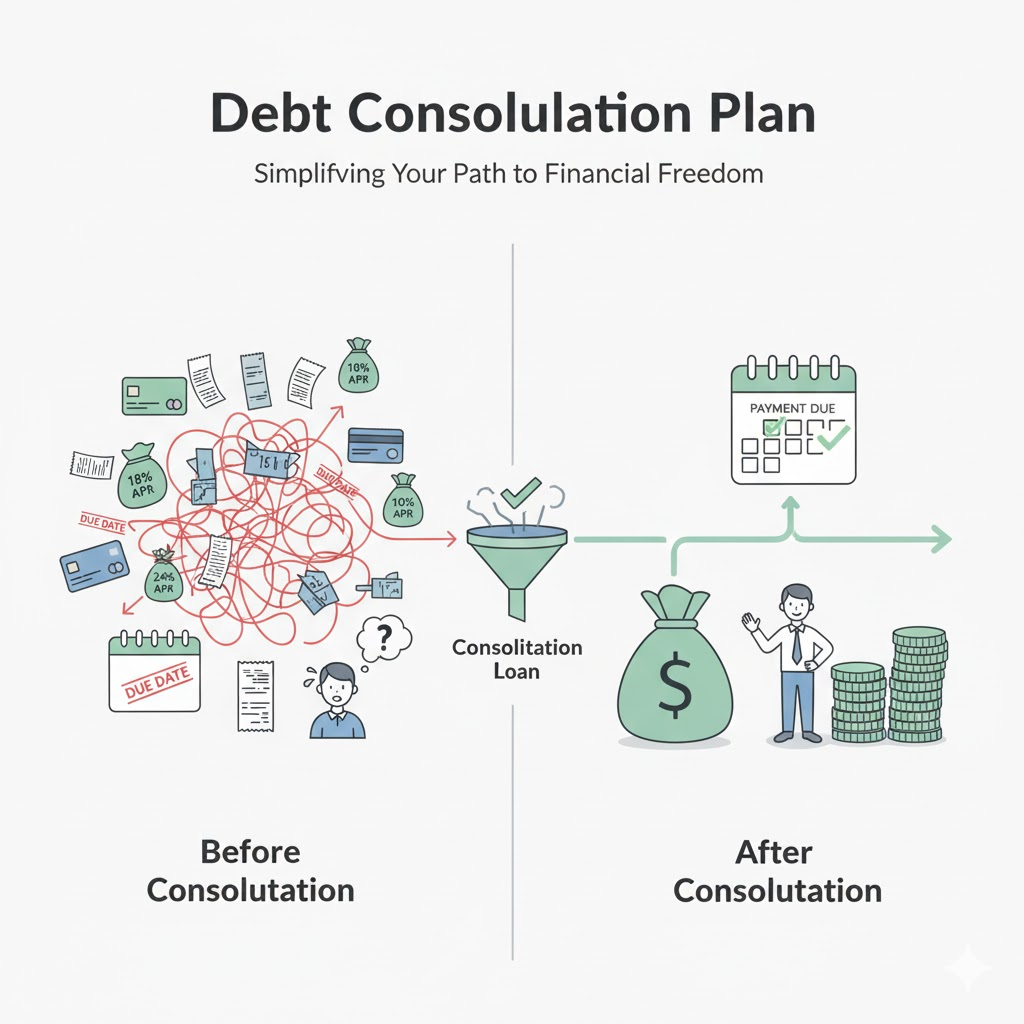

Juggling multiple debts – credit cards, personal loans, medical bills, or store financing – can feel overwhelming. Each debt often comes with its own interest rate, due date, and payment amount, making it a complex and stressful task to manage. This is where a Debt Consolidation Plan can offer a lifeline, simplifying your repayment process and potentially saving you money.

What is Debt Consolidation?

Debt consolidation is the process of combining several debts into a single, larger loan. The goal is often to secure a lower interest rate, reduce your monthly payment, or simply streamline your finances by having only one bill to pay each month.

It’s not about erasing debt, but rather reorganizing it to make repayment more manageable and efficient.

Why Consider Debt Consolidation?

- Lower Interest Rates: If you have high-interest debts (like credit card balances), consolidating them into a new loan with a lower interest rate can significantly reduce the total amount you pay over time.

- Simplified Payments: Instead of multiple payments to different lenders, you’ll have just one monthly payment, making budgeting and tracking much easier.

- Reduced Monthly Payments: A longer repayment term on a consolidated loan can lower your monthly outlay, freeing up cash flow. Be cautious, though, as a longer term might mean paying more interest overall, even if the rate is lower.

- Clearer Path to Debt Freedom: A single, clear repayment plan can provide a psychological boost and make your journey out of debt feel more achievable.

Popular Debt Consolidation Options

There are several common ways to consolidate debt, each with its own pros and cons:

1. Personal Loan

- How it works: You take out a new, unsecured personal loan from a bank, credit union, or online lender. The funds are then used to pay off your existing smaller debts.

- Pros: Fixed interest rates and fixed monthly payments make budgeting predictable. Can be a good option for those with good credit scores to secure a low rate.

- Cons: Requires a decent credit score for favorable terms. If approved for a high rate, it might not offer much saving.

2. Balance Transfer Credit Card

- How it works: You transfer high-interest credit card balances to a new credit card that offers a 0% introductory APR for a promotional period (e.g., 12-21 months).

- Pros: Can save a significant amount on interest if you pay off the balance within the promotional period.

- Cons: Requires excellent credit. Typically comes with a balance transfer fee (e.g., 3-5% of the transferred amount). If you don’t pay off the balance before the promotional period ends, the interest rate can jump dramatically.

3. Home Equity Loan or HELOC (Home Equity Line of Credit)

- How it works: You borrow against the equity in your home. A home equity loan provides a lump sum, while a HELOC is a revolving line of credit.

- Pros: Often offers significantly lower interest rates than unsecured loans because your home serves as collateral. The interest paid may be tax-deductible (consult a tax advisor).

- Cons: Your home is at risk! If you can’t make payments, you could lose your home. It’s generally not recommended for unsecured debt unless you’re very confident in your ability to repay.

4. Debt Management Plan (DMP) through Credit Counseling

- How it works: A non-profit credit counseling agency works with your creditors to create a single, affordable monthly payment plan. They may negotiate lower interest rates or waive fees.

- Pros: No new loan is taken out. Provides professional guidance and structured repayment.

- Cons: May require closing credit card accounts. Doesn’t always lower the interest rate as much as a personal loan for those with good credit.

Before You Consolidate: Important Considerations

- Credit Score: A good credit score will give you access to the best consolidation loan rates. Work on improving your score before applying if possible.

- Fees: Be aware of any origination fees on personal loans, balance transfer fees on credit cards, or closing costs on home equity products.

- Interest Rate vs. Total Cost: A lower monthly payment might come with a longer repayment term, meaning you pay more in total interest over the life of the loan. Always calculate the total cost.

- Address Spending Habits: Consolidation is a tool, not a cure. If you don’t address the underlying spending habits that led to debt, you could easily fall back into the same trap with new debt.

Conclusion

Debt consolidation can be a powerful strategy to simplify your finances and accelerate your journey to debt freedom. By choosing the right method and committing to responsible financial habits, you can transform a tangled web of bills into a clear, manageable path forward.