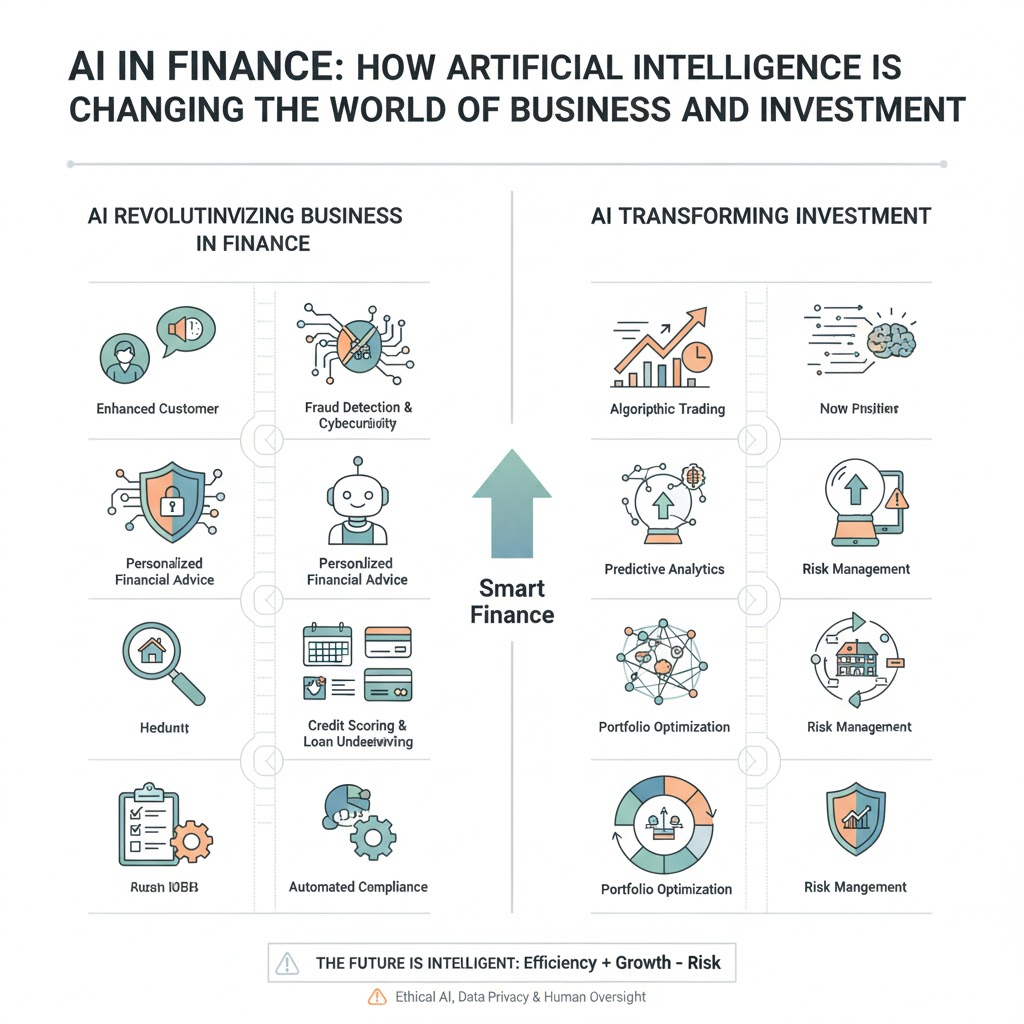

Artificial Intelligence (AI) is no longer a futuristic concept; it’s a present-day reality rapidly transforming industries worldwide. In the complex, data-rich world of finance, AI is proving to be a game-changer, revolutionizing everything from customer service and fraud detection to investment strategies and risk management. For businesses and investors alike, understanding how AI is impacting finance is crucial for staying competitive and making informed decisions.

What is AI in Finance?

AI in finance refers to the application of artificial intelligence technologies—such as machine learning, natural language processing (NLP), and deep learning—to automate tasks, analyze vast datasets, predict market trends, detect anomalies, and personalize financial services. It’s about enabling machines to perform cognitive functions traditionally associated with human intelligence, but at a scale and speed impossible for humans.

How AI is Revolutionizing Business in Finance

- Enhanced Customer Service (Chatbots & Virtual Assistants):

- AI-powered chatbots and virtual assistants handle routine customer inquiries 24/7, providing instant support, answering FAQs, and guiding users through transactions. This frees up human agents to focus on more complex issues, improving efficiency and customer satisfaction.

- Example: Banks using chatbots to help customers check balances, transfer funds, or apply for loans.

- Fraud Detection & Cybersecurity:

- AI algorithms analyze enormous volumes of transaction data in real-time to identify unusual patterns or anomalies indicative of fraudulent activity. This allows financial institutions to detect and prevent fraud much faster and more accurately than traditional rule-based systems.

- Example: AI flagging unusual credit card spending patterns to prevent unauthorized transactions.

- Personalized Financial Advice & Robo-Advisors:

- AI-driven robo-advisors offer automated, algorithm-driven financial planning services. They analyze an investor’s goals, risk tolerance, and financial situation to recommend diversified portfolios at a lower cost than human advisors.

- Example: Platforms using AI to automatically rebalance portfolios or adjust investment strategies based on market changes and user profiles.

- Credit Scoring & Loan Underwriting:

- AI can analyze a broader range of data points (beyond traditional credit scores) to assess creditworthiness more accurately, especially for individuals or small businesses with limited credit history. This can lead to faster loan approvals and more inclusive lending.

- Example: Fintech lenders using AI to evaluate non-traditional data like rent payments or utility bills.

- Automated Compliance & Regulation (RegTech):

- AI helps financial institutions navigate the complex and ever-changing regulatory landscape. AI-powered RegTech solutions automate compliance checks, monitor transactions for suspicious activity, and generate regulatory reports, significantly reducing human error and operational costs.

How AI is Transforming Investment

- Algorithmic Trading & High-Frequency Trading:

- AI algorithms execute trades at incredibly high speeds, identifying and capitalizing on fleeting market opportunities that human traders would miss.

- Example: AI models analyzing news sentiment, economic indicators, and technical charts to make rapid buy/sell decisions.

- Predictive Analytics & Market Forecasting:

- Machine learning models can analyze vast datasets (including news articles, social media sentiment, economic reports, and historical price data) to identify subtle patterns and predict future market movements, stock prices, or currency fluctuations with higher accuracy.

- Example: Hedge funds using AI to forecast commodity prices or predict stock volatility.

- Risk Management:

- AI enhances risk assessment by analyzing complex portfolios, identifying potential exposures, stress-testing scenarios, and predicting credit defaults or market crashes more effectively. This helps investors and institutions make more resilient decisions.

- Example: AI systems evaluating the interconnectedness of different assets in a portfolio to gauge systemic risk.

- Portfolio Optimization:

- AI algorithms can continuously optimize investment portfolios based on an investor’s risk profile, desired returns, and real-time market conditions, aiming for the best possible asset allocation.

The Future is Intelligent

AI’s integration into finance is only set to deepen. We can expect more sophisticated predictive models, hyper-personalized financial products, and even more efficient and secure transaction systems. While AI offers immense opportunities for efficiency and growth, it also raises important questions about data privacy, algorithmic bias, and the need for human oversight. The key will be to leverage AI’s power responsibly, ensuring ethical deployment and maintaining a human-centric approach to financial well-being.