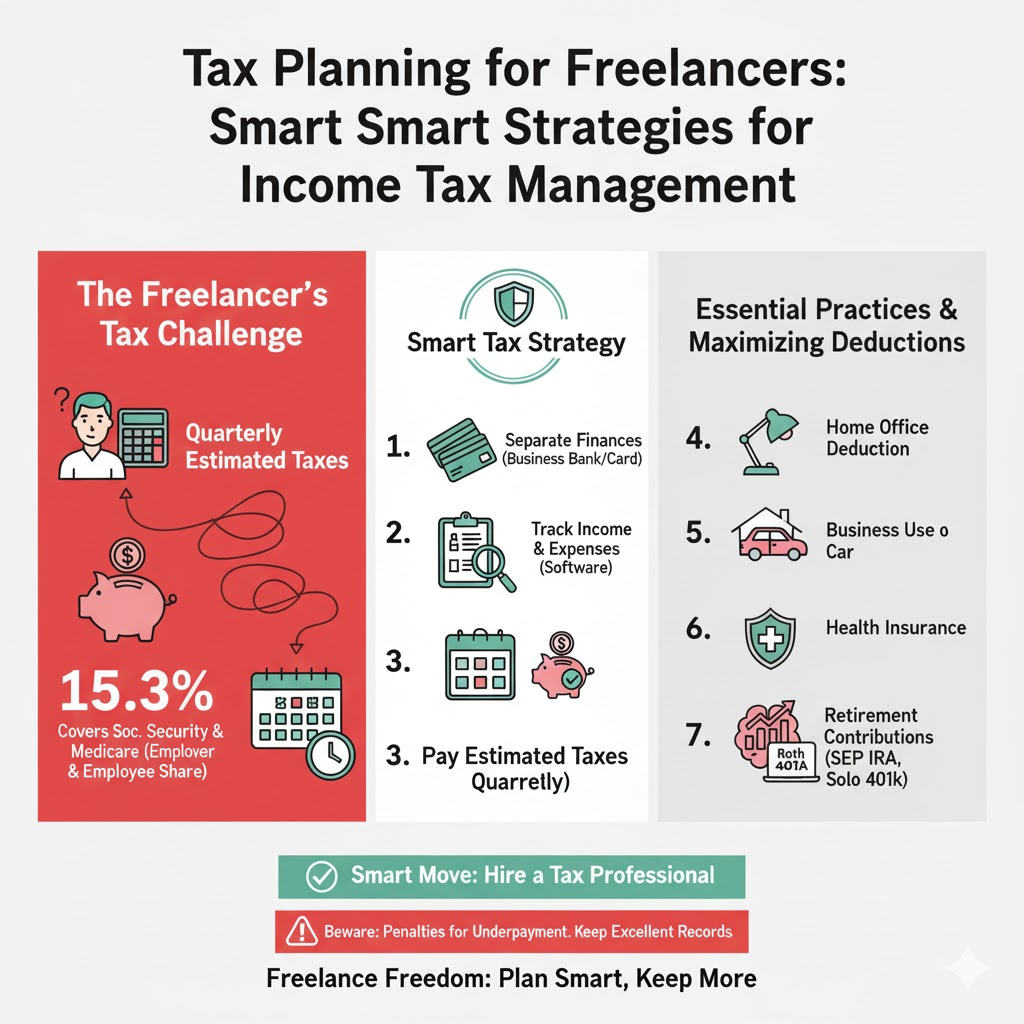

Freelancing offers incredible freedom and flexibility, but it also comes with unique financial responsibilities, especially when it comes to taxes. Unlike salaried employees who have taxes automatically withheld, freelancers are responsible for calculating, reporting, and paying their own income and self-employment taxes. Effective tax planning isn’t just about avoiding penalties; it’s about maximizing your take-home pay and ensuring financial stability.

The Freelancer’s Tax Challenge: Self-Employment Tax

The biggest difference for freelancers is the Self-Employment Tax. This covers Social Security and Medicare contributions that are typically split between an employer and employee. As a freelancer, you’re both, so you’re responsible for both halves (currently 15.3% on net earnings up to a certain limit, then 2.9% for Medicare beyond that). This is in addition to your regular income tax.

Key Strategies for Effective Tax Planning

1. Separate Business Finances

- Open a Dedicated Business Bank Account: This is non-negotiable. Mixing personal and business finances makes tracking income and expenses for tax purposes incredibly difficult and can complicate audits.

- Get a Business Credit Card: Use it exclusively for business expenses. This further simplifies expense tracking.

2. Track All Income and Expenses Meticulously

This is the cornerstone of good freelance tax planning.

- Income Tracking: Keep a clear record of all payments received, noting the source, date, and amount.

- Expense Tracking: Every legitimate business expense reduces your taxable income. Keep receipts (digital or physical) for everything, including:

- Home office expenses (a portion of rent/mortgage, utilities, internet)

- Software subscriptions

- Professional development (courses, conferences)

- Website hosting & domain fees

- Marketing & advertising costs

- Office supplies

- Travel for business

- Health insurance premiums (in some cases)

- Professional fees (accountants, lawyers)

- Use Accounting Software: Tools like QuickBooks Self-Employed, FreshBooks, or Wave can automate expense tracking, invoice generation, and financial reporting.

3. Pay Estimated Taxes Quarterly

As a freelancer, taxes aren’t withheld from your income, so you’re generally required to pay estimated taxes throughout the year.

- Avoid Penalties: If you expect to owe more than a certain amount (e.g., $1,000 in the U.S.), you must pay quarterly. Failure to do so can result in penalties.

- Estimate Accurately: Base your quarterly payments on your projected annual income and deductions. It’s often better to slightly overestimate than underestimate.

- Set Aside Money Regularly: Don’t wait until tax time. Dedicate a percentage of every payment you receive (e.g., 25-35%, depending on your income and location) to a separate savings account specifically for taxes.

4. Maximize Deductions and Write-Offs

Many business expenses are tax-deductible, reducing your taxable income.

- Home Office Deduction: If you have a dedicated space used exclusively and regularly for business, you can deduct a portion of your home expenses (actual expenses or simplified option).

- Business Use of Car: Deduct mileage or actual expenses related to business travel.

- Health Insurance Premiums: If you’re self-employed and not eligible for an employer-sponsored plan, you might be able to deduct these.

- Retirement Contributions: Contributing to a SEP IRA, Solo 401(k), or SIMPLE IRA can significantly reduce your taxable income and build your retirement nest egg. This is one of the most powerful tax strategies for freelancers.

- Professional Development: Costs for courses, workshops, or certifications related to your freelance work are often deductible.

5. Consider Your Business Structure

- Sole Proprietorship: Simple to set up, but offers no liability protection and taxes are paid on your personal return (Schedule C).

- LLC (Limited Liability Company): Provides personal liability protection. You can still be taxed as a sole proprietorship (pass-through) or elect to be taxed as an S-Corp.

- S-Corp Election: For profitable freelancers, electing S-Corp status for an LLC can sometimes reduce self-employment tax, as you can pay yourself a reasonable salary (subject to SE tax) and take the remaining profits as distributions (not subject to SE tax). Consult a tax professional for this complex strategy.

6. Hire a Tax Professional

While you can DIY, a qualified accountant or tax preparer specializing in small businesses and freelancers can:

- Identify all eligible deductions.

- Advise on the best business structure for your situation.

- Help accurately calculate estimated taxes.

- Ensure compliance and potentially save you more money than their fee.

Conclusion

Freelancing offers immense professional and personal rewards, but mastering your tax obligations is key to its financial success. By adopting disciplined habits like separating finances, meticulous record-keeping, paying quarterly estimated taxes, and maximizing deductions, you can navigate the tax landscape confidently. Proactive tax planning isn’t just a requirement; it’s a strategic move that empowers you to keep more of your hard-earned money and secure your financial future.