In our increasingly digital world, online transactions have become the norm for everything from shopping and banking to investing and paying bills. While this convenience is invaluable, it also exposes us to significant risks from cyber threats. Protecting your financial safety in the digital realm is paramount, requiring vigilance, smart practices, and an understanding of how to defend against hacking attempts.

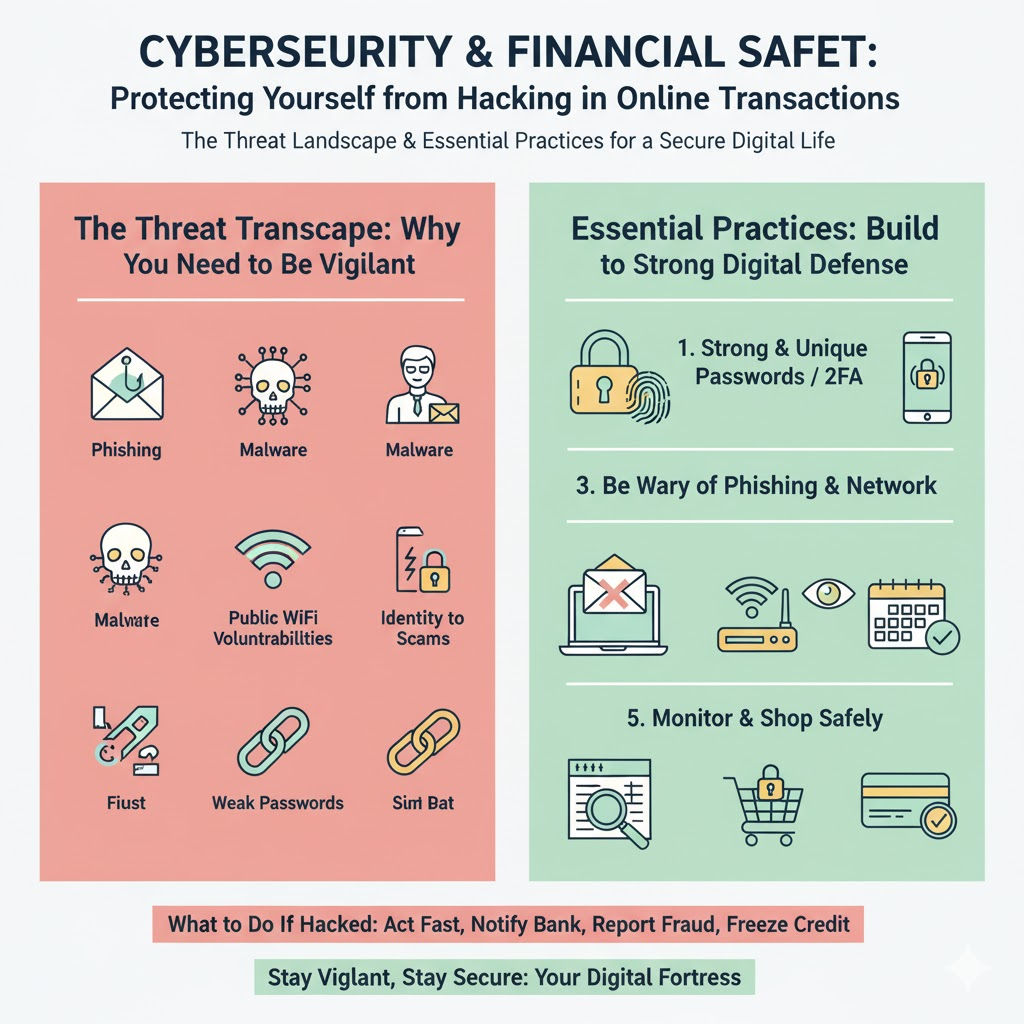

The Threat Landscape: Why You Need to Be Vigilant

Cybercriminals are constantly evolving their tactics, employing sophisticated methods to gain unauthorized access to your financial information. Common threats include:

- Phishing: Deceptive emails, texts, or websites designed to trick you into revealing personal information (passwords, bank details).

- Malware: Malicious software (viruses, spyware, ransomware) installed on your device to steal data or disrupt operations.

- Identity Theft: Stealing your personal information to open accounts, make purchases, or file taxes in your name.

- Public Wi-Fi Vulnerabilities: Unsecured public networks can be easily intercepted by hackers.

- Weak Passwords: Easily guessed or reused passwords are a hacker’s easy entry point.

- Man-in-the-Middle Attacks: Intercepting communication between two parties to steal data.

Essential Practices for Cybersecurity & Financial Safety

Protecting yourself requires a multi-layered approach. Here’s how to build a strong digital defense:

1. Strong & Unique Passwords / Passphrases

- Complexity: Use a mix of uppercase and lowercase letters, numbers, and symbols.

- Length: Longer passwords (12+ characters) are much harder to crack. Consider passphrases (e.g., “Correct!Horse!Battery!Staple!”).

- Uniqueness: Never reuse passwords across different accounts. If one account is compromised, others remain safe.

- Password Manager: Use a reputable password manager (e.g., LastPass, 1Password, Bitwarden) to securely store and generate complex, unique passwords for all your accounts.

2. Enable Two-Factor Authentication (2FA) / Multi-Factor Authentication (MFA)

- This adds an extra layer of security beyond just a password. Even if a hacker gets your password, they can’t access your account without the second factor.

- Methods: This could be a code sent to your phone, a fingerprint scan, facial recognition, or a token from an authenticator app (e.g., Google Authenticator, Authy).

- Enable it everywhere possible, especially for financial accounts.

3. Be Wary of Phishing & Scams

- Verify Senders: Always check the sender’s email address carefully. It might look legitimate at first glance but have subtle differences.

- Don’t Click Suspicious Links: Hover over links before clicking to see the actual URL. If it looks suspicious, don’t click.

- Don’t Download Unknown Attachments: Attachments from unknown sources can contain malware.

- Legitimate organizations will rarely ask for sensitive information (passwords, PINs) via email or text. If in doubt, directly visit the organization’s official website or call them using a verified phone number.

4. Secure Your Devices & Network

- Keep Software Updated: Regularly update your operating system, web browsers, and all applications. Updates often include critical security patches.

- Install Antivirus/Anti-Malware: Use reputable security software on all your devices (computers, smartphones) and keep it updated.

- Use a Firewall: Enable your computer’s firewall.

- Secure Your Wi-Fi: Use strong, unique passwords for your home Wi-Fi network. Avoid using public Wi-Fi for sensitive transactions; if you must, use a Virtual Private Network (VPN).

5. Monitor Your Financial Accounts Regularly

- Check Statements: Review your bank and credit card statements frequently for any unauthorized transactions.

- Set Up Alerts: Enable transaction alerts from your bank or credit card company for unusual activity or large purchases.

- Monitor Credit Reports: Periodically check your credit reports for signs of identity theft.

6. Practice Safe Online Shopping

- Look for “HTTPS”: Only make purchases on websites that use “https://” in their URL and have a padlock icon in the browser address bar.

- Avoid Saving Card Details: Don’t let websites save your credit card information unless absolutely necessary.

- Use Secure Payment Methods: Opt for payment options like PayPal or mobile wallets, which often add an extra layer of security as your primary card details aren’t directly shared with merchants.

What to Do If You’re Hacked

Even with the best precautions, hacks can happen. If you suspect your financial information has been compromised:

- Act Immediately: Change passwords for all affected accounts, starting with your most critical ones.

- Notify Your Bank/Credit Card Company: Report any fraudulent activity immediately.

- Monitor Accounts Closely: Keep a close watch on all financial accounts for unusual transactions.

- Report to Authorities: File a report with relevant law enforcement or cybersecurity authorities.

- Freeze Your Credit: Consider freezing your credit to prevent identity thieves from opening new accounts in your name.

Conclusion

Our financial lives are increasingly intertwined with the digital world. By adopting strong cybersecurity practices, staying vigilant against evolving threats, and knowing how to respond in case of a breach, you can significantly enhance your financial safety and maintain peace of mind in every online transaction.