In today’s fast-evolving global economy, the way money changes hands has undergone a radical transformation. Traditional cash and check payments are steadily being replaced by Digital Payment Systems, which have become an indispensable tool for businesses of all sizes. These online payment gateways are not just conveniences; they are central to modern commerce, driving efficiency, expanding reach, and paving the way for the future of financial transactions.

What are Digital Payment Systems?

Digital payment systems are electronic methods of transferring funds from a payer to a payee without the use of physical cash or checks. They leverage technology to facilitate secure and instant financial transactions, predominantly online or via mobile devices.

Key Components & Examples:

- Online Payment Gateways: Services that authorize credit card or direct payments for e-commerce (e.g., PayPal, Stripe, Square).

- Mobile Wallets: Digital versions of physical wallets stored on smartphones, enabling tap-to-pay or QR code payments (e.g., Apple Pay, Google Pay, Samsung Pay).

- Bank Transfers (Online/Real-time): Direct electronic transfers between bank accounts.

- Cryptocurrency: Decentralized digital currencies operating on blockchain technology (e.g., Bitcoin, Ethereum).

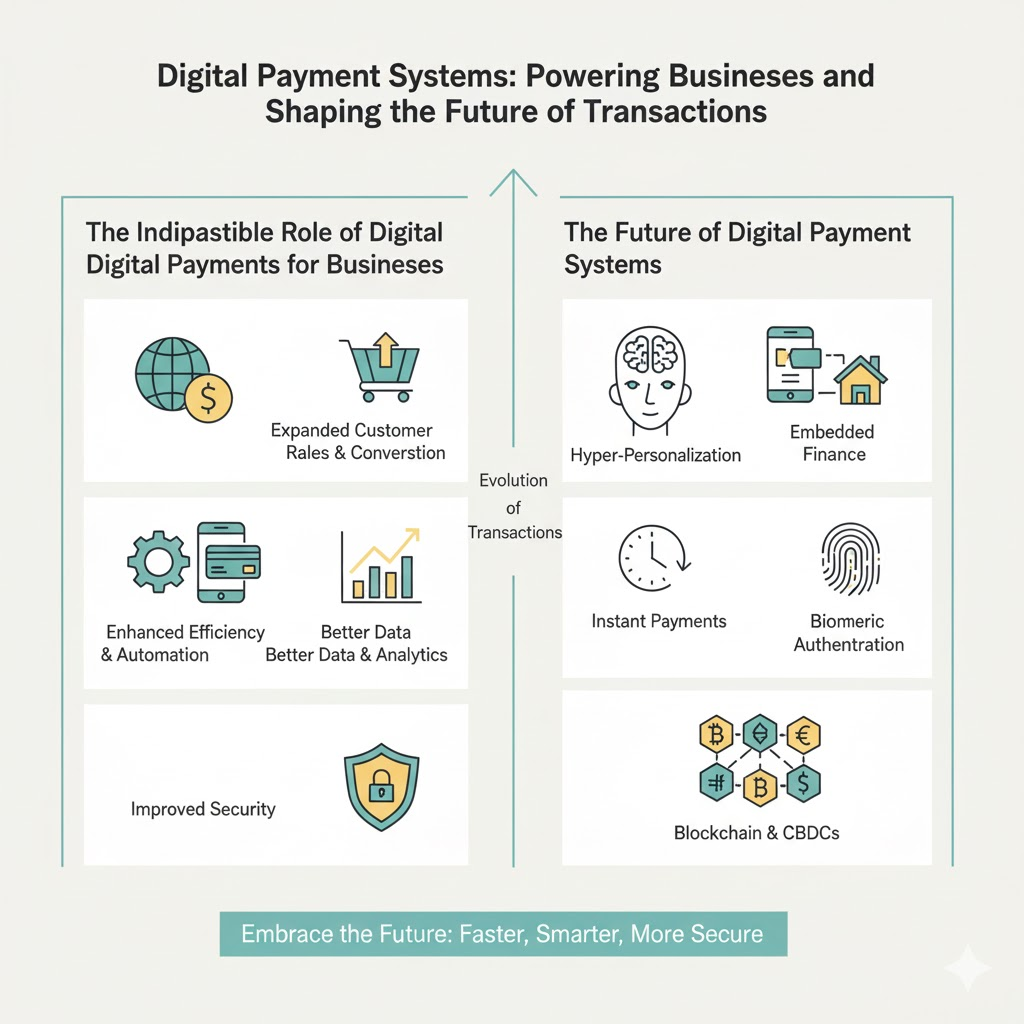

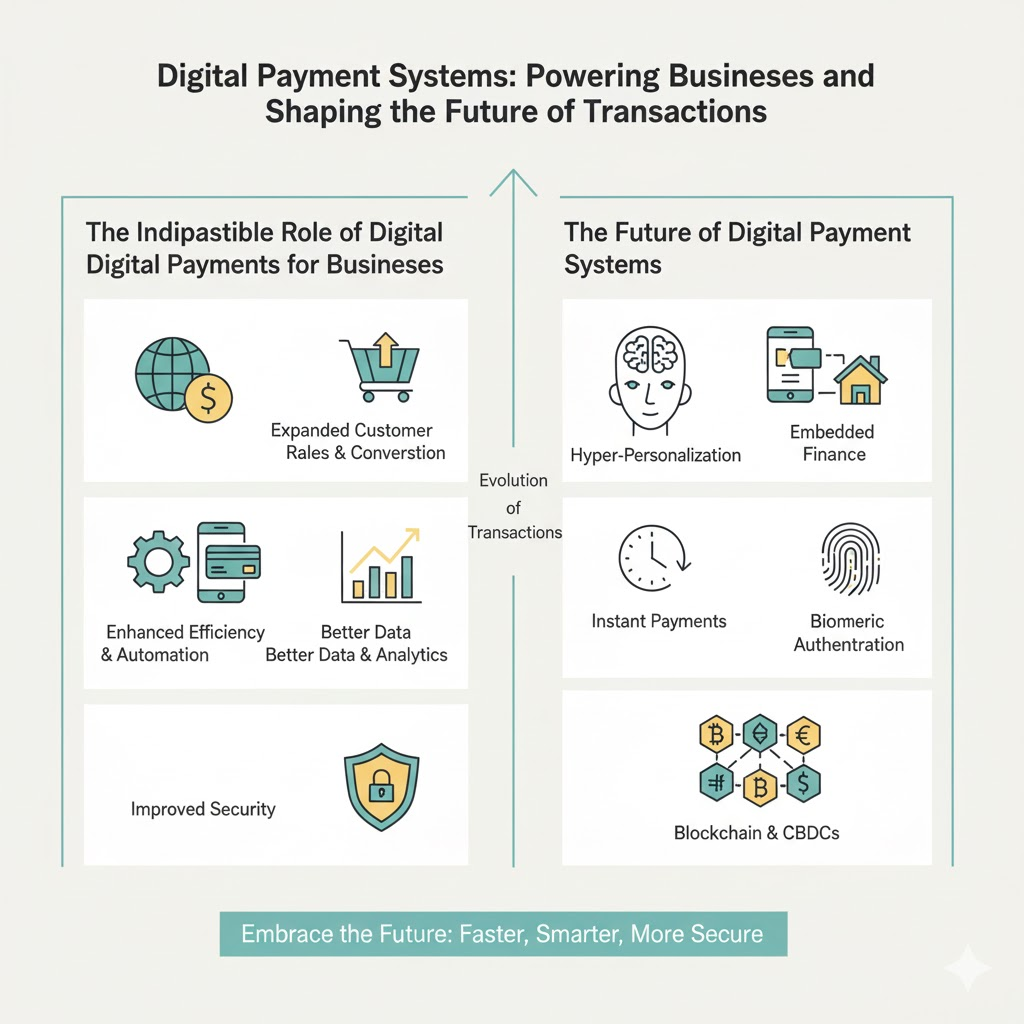

The Indispensable Role of Digital Payments for Businesses

Digital payment systems offer a multitude of benefits that are critical for modern businesses:

- Expanded Customer Reach: By accepting online payments, businesses can sell to customers globally, breaking geographical barriers and accessing larger markets.

- Increased Sales & Conversion Rates: Offering diverse payment options (credit cards, mobile wallets, buy-now-pay-later) caters to customer preferences, reducing cart abandonment and boosting sales.

- Enhanced Efficiency & Automation:

- Faster Transactions: Payments are processed almost instantly, improving cash flow.

- Reduced Manual Work: Automation of invoicing, reconciliation, and record-keeping saves time and minimizes human error.

- Lower Costs: Reduces the need for cash handling, banking trips, and processing paper checks.

- Improved Security: Digital platforms employ advanced encryption, tokenization, and fraud detection tools, offering greater security than carrying large sums of cash.

- Better Data & Analytics: Digital transactions provide valuable data on customer spending habits, sales trends, and inventory needs, enabling businesses to make more informed decisions.

- Seamless Customer Experience: Quick, convenient, and flexible payment options significantly enhance customer satisfaction.

- Support for Remote Work & E-commerce: Crucial for businesses operating online or with remote teams, facilitating payments and payroll regardless of location.

The Future of Digital Payment Systems

The evolution of digital payments is far from over. We can anticipate several key trends shaping its future:

- Hyper-Personalization: AI and machine learning will drive even more personalized payment experiences, offering tailored discounts, loyalty programs, and credit options.

- Further Integration & Embedded Finance: Payment capabilities will be seamlessly integrated into more apps, platforms, and even physical objects (IoT devices), making transactions almost invisible.

- Rise of Instant Payments: Real-time payment networks will become standard globally, ensuring funds transfer instantly 24/7.

- Growth of Biometric Authentication: Fingerprint, facial, and even voice recognition will become more common for payment authorization, enhancing security and convenience.

- Blockchain & CBDCs (Central Bank Digital Currencies): Blockchain technology could streamline cross-border payments, while many central banks are exploring their own digital currencies, which could transform the payment infrastructure.

- Voice-Activated Payments: As smart speakers and virtual assistants become more prevalent, voice commands for payments will grow.

- Enhanced Fraud Prevention: AI will continue to advance, making fraud detection even more sophisticated and proactive.

Conclusion

Digital payment systems are no longer a luxury but a necessity for businesses aiming to thrive in the modern economy. They streamline operations, enhance security, expand market reach, and fundamentally improve the customer experience. As technology continues to advance, the future promises even more innovative, efficient, and integrated payment solutions, making it imperative for businesses to embrace and adapt to this ever-evolving digital landscape.