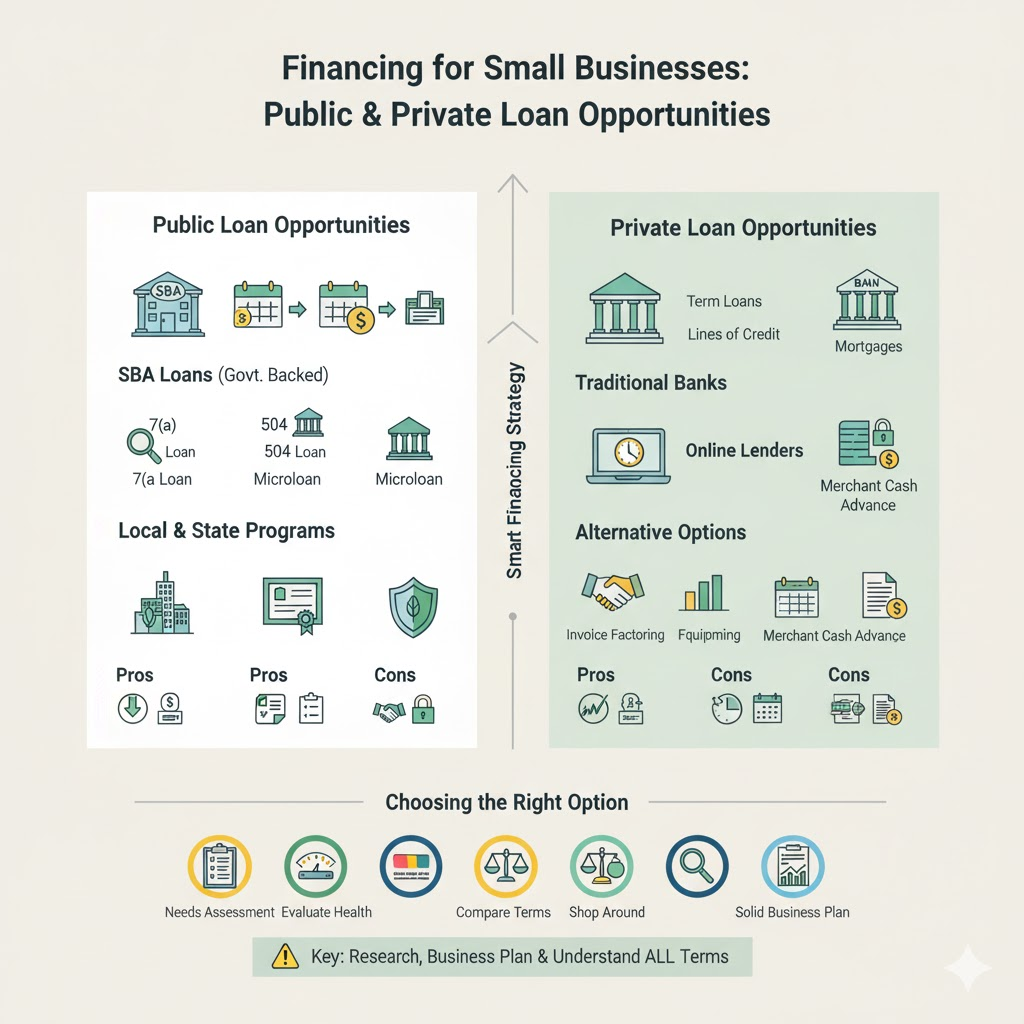

Small businesses are the backbone of any economy, driving innovation, creating jobs, and fostering local growth. However, one of the biggest challenges for entrepreneurs is securing adequate funding to start, operate, and expand their ventures. Understanding the diverse landscape of public and private loan opportunities is crucial for small enterprises seeking financial lifelines.

Why Small Businesses Need Financing

Small businesses require financing for a multitude of reasons:

- Startup Costs: To cover initial expenses like equipment, inventory, rent, and legal fees.

- Working Capital: To manage day-to-day operations, payroll, and unexpected cash flow gaps.

- Expansion: To open new locations, launch new products, or hire more staff.

- Equipment Purchase: To acquire machinery, vehicles, or technology necessary for operations.

- Inventory: To purchase goods for sale, especially during peak seasons.

Public Loan Opportunities (Government-Backed)

Government-backed loans are often designed to support small businesses that might not qualify for traditional bank loans, offering more favorable terms, lower interest rates, or longer repayment periods.

1. Small Business Administration (SBA) Loans (U.S. Example)

The SBA doesn’t lend money directly but guarantees a portion of loans made by commercial lenders (banks, credit unions). This guarantee reduces the risk for lenders, making them more willing to lend to small businesses.

- SBA 7(a) Loan Program: The most common and flexible SBA loan, suitable for a wide range of purposes including working capital, equipment purchase, and real estate. Loan amounts can go up to $5 million.

- SBA 504 Loan Program: Provides long-term, fixed-rate financing for major fixed assets like real estate or machinery. Often involves a partnership between a conventional lender and a Certified Development Company (CDC).

- SBA Microloan Program: Offers smaller loans (up to $50,000) for working capital or inventory, often aimed at underserved communities or startups.

Pros of SBA Loans:

- Lower down payments

- Longer repayment terms (reducing monthly payments)

- Often lower interest rates

- Good for businesses that can’t get conventional financing

Cons of SBA Loans:

- Can have a lengthy application process

- Strict eligibility requirements

- Collateral often required

2. Local & State Government Programs

Many state, county, and city governments offer their own loan programs, grants, or tax incentives to stimulate local economies and support specific industries. These often target businesses in designated revitalization zones or those creating specific types of jobs.

Private Loan Opportunities

Private lenders offer a wider variety of loan products, often with faster approval processes, but terms can vary greatly depending on the lender and the borrower’s creditworthiness.

1. Traditional Bank Loans

- Term Loans: A lump sum of money repaid with fixed interest over a set period. Good for equipment or expansion.

- Lines of Credit: Revolving credit that you can draw from as needed, up to a certain limit. Ideal for managing cash flow fluctuations.

- Commercial Mortgages: Used for purchasing or refinancing commercial real estate.

Pros of Bank Loans:

- Often the lowest interest rates for qualified borrowers

- Strong relationships with banks can be beneficial

Cons of Bank Loans:

- Strict eligibility criteria (strong credit score, collateral, proven business history)

- Slower approval process compared to online lenders

2. Online Lenders

These non-traditional lenders operate entirely online, offering a streamlined application process and faster funding decisions.

- Pros: Quick approvals, less stringent requirements than banks for some products, convenient application.

- Cons: Can have higher interest rates, especially for businesses with weaker profiles.

3. Merchant Cash Advances (MCAs)

- How it works: A lump sum is provided in exchange for a percentage of future credit/debit card sales.

- Pros: Quick access to funds, repayment adjusts with sales volume.

- Cons: Extremely high APRs (often disguised as factor rates), can become a debt trap. Best used as a last resort for very short-term needs.

4. Invoice Factoring/Financing

- How it works: You sell your outstanding invoices (accounts receivable) to a third party at a discount for immediate cash.

- Pros: Solves immediate cash flow problems from slow-paying customers, doesn’t create new debt.

- Cons: Expensive fees, customers know a third party is involved, can impact customer relationships.

5. Equipment Financing

- How it works: A loan specifically for purchasing equipment, with the equipment itself serving as collateral.

- Pros: Easier to qualify for, lower interest rates, preserves working capital.

- Cons: Funds can only be used for equipment.

Choosing the Right Financing Option

- Assess Your Needs: How much do you need? What is it for? How quickly do you need it?

- Evaluate Your Business Health: Do you have strong credit, steady revenue, and collateral?

- Compare Terms: Look beyond just the interest rate. Consider fees, repayment terms, and collateral requirements.

- Shop Around: Don’t settle for the first offer. Compare options from different public and private lenders.

- Prepare a Solid Business Plan: Lenders want to see a clear vision, financial projections, and a repayment strategy.

Conclusion

Securing financing is a critical step for any small business. By understanding the various public and private loan opportunities available, entrepreneurs can make informed decisions that align with their business goals and financial health. Careful planning, thorough research, and a clear understanding of the terms involved are key to successfully navigating the world of small business financing and fueling your enterprise’s growth.