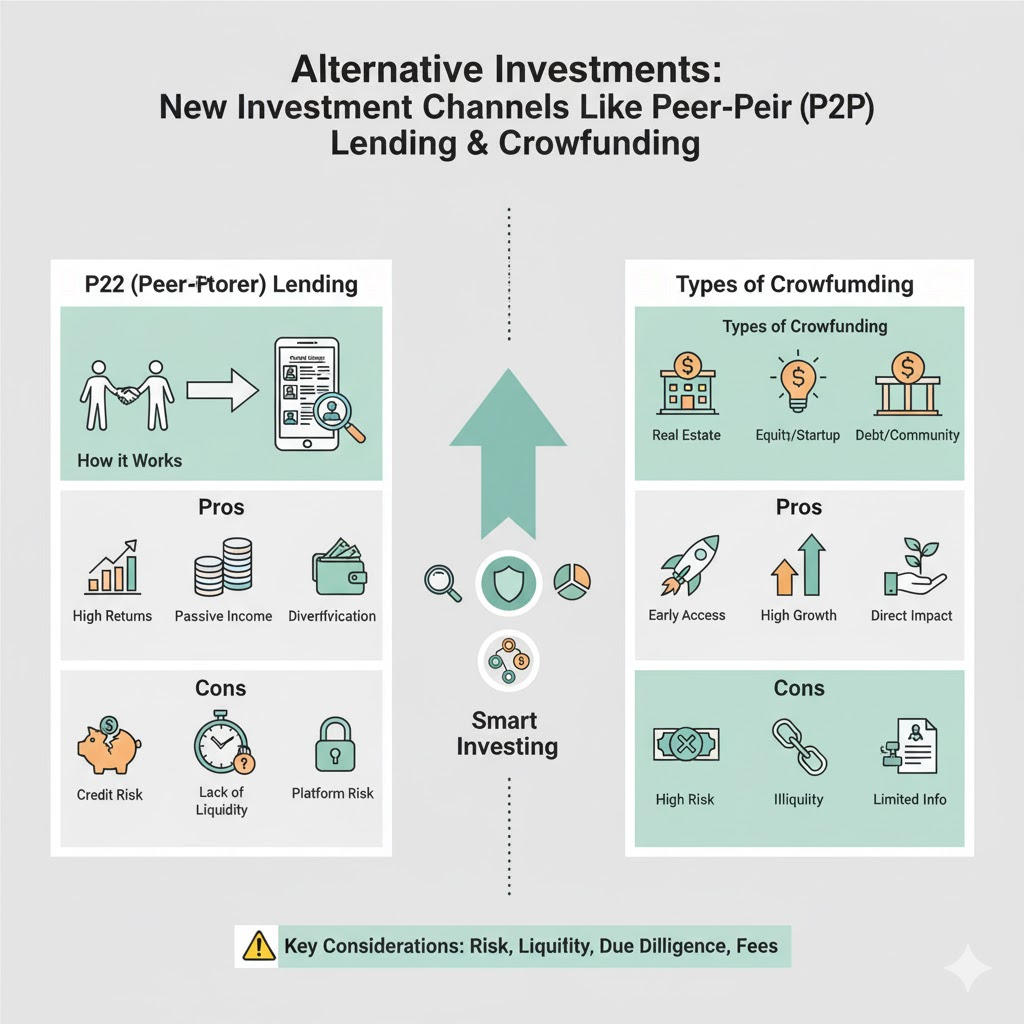

In an era of evolving financial landscapes, traditional investments like stocks, bonds, and real estate are no longer the only options for savvy investors. A new class of assets, known as Alternative Investments, is gaining traction, offering unique opportunities for diversification, potentially higher returns, and direct impact. Among the most accessible of these are Peer-to-Peer (P2P) Lending and Crowdfunding.

What are Alternative Investments?

Alternative investments are financial assets that do not fall into conventional categories like stocks, bonds, and cash. They often have different risk/return profiles, liquidity characteristics, and market drivers compared to traditional assets. Examples include private equity, hedge funds, commodities, real estate (beyond publicly traded REITs), collectibles, and crucially, P2P lending and crowdfunding.

Why Consider Alternative Investments?

- Diversification: They can help diversify your portfolio, as their performance may not be directly correlated with traditional markets, potentially reducing overall portfolio risk.

- Higher Returns Potential: Some alternative investments offer the potential for higher returns, especially in niche markets or illiquid assets.

- Inflation Hedge: Certain alternatives, like commodities or real assets, can serve as a hedge against inflation.

- Impact Investing: Many alternative channels allow investors to put their money directly into projects or businesses they believe in, aligning investments with personal values.

- Access to New Markets: They open up opportunities that were once exclusive to institutional investors or the ultra-wealthy.

Exploring P2P (Peer-to-Peer) Lending

P2P lending connects individual borrowers directly with individual investors, cutting out traditional financial intermediaries like banks. Platforms facilitate this process, managing loan applications, risk assessment, and repayment collection.

How it Works:

- Borrower Application: Individuals or small businesses apply for a loan through a P2P platform.

- Credit Assessment: The platform assesses the borrower’s creditworthiness and assigns a risk grade and interest rate.

- Investor Funding: Investors browse available loan listings, often diversifying by investing small amounts across many loans (e.g., $25 per loan).

- Repayment: Borrowers make monthly payments (principal + interest) to the platform, which then distributes the funds to investors.

Pros of P2P Lending:

- Potentially Higher Returns: Can offer higher interest rates than traditional savings accounts or bonds.

- Passive Income: Generates regular monthly income from loan repayments.

- Diversification: Ability to invest in hundreds of small loans to spread risk.

- Direct Impact: You can choose to fund loans for individuals or businesses you want to support.

Cons of P2P Lending:

- Credit Risk: Risk of borrower default. While platforms conduct checks, defaults can occur, leading to loss of principal.

- Lack of Liquidity: Investments are often tied up for the loan term (e.g., 3-5 years). Early withdrawal options may be limited or come with fees.

- Platform Risk: The platform itself could fail, though investor protections may be in place.

- Tax Complexity: Income from P2P lending is typically taxed as ordinary income.

Understanding Crowdfunding

Crowdfunding involves raising small amounts of capital from a large number of individuals, typically via internet platforms. It’s often used by startups or small businesses for specific projects or ventures.

Types of Crowdfunding:

- Equity Crowdfunding: Investors receive a share of equity in the company, becoming partial owners. This can offer high returns if the company succeeds, but also carries significant risk if it fails.

- Debt Crowdfunding: Similar to P2P lending, but often for businesses or specific projects, where investors receive interest on their loan.

- Real Estate Crowdfunding: Investors pool money to invest in commercial or residential real estate projects, earning returns from rental income or property appreciation.

Pros of Crowdfunding:

- Access to Early-Stage Investments: Opportunity to invest in promising startups or real estate projects that were previously inaccessible.

- High Growth Potential: Successful startups can yield exponential returns.

- Direct Impact: Support businesses or projects aligning with your interests.

- Diversification: Invest across various ventures.

Cons of Crowdfunding:

- High Risk of Loss: Many startups fail. Real estate projects can face delays or market downturns. You could lose your entire investment.

- Illiquidity: Investments are typically long-term and cannot be easily sold.

- Limited Information: Due diligence can be challenging for private companies.

- Lack of Control: As a small investor, you have little to no say in company operations.

Key Considerations Before Investing in Alternatives

- Risk Tolerance: Alternative investments are often riskier than traditional ones. Only invest what you can afford to lose.

- Diversification: Don’t put all your “alternative” eggs in one basket. Spread your investments across different platforms and types of alternatives.

- Liquidity: Understand how long your money will be tied up and if there are any exit strategies.

- Due Diligence: Thoroughly research the platform, the specific investment opportunity, and the underlying assets/borrowers.

- Fees: Be aware of any platform fees, management fees, or success fees.

- Regulatory Environment: Understand the regulations governing these platforms in your region.

Conclusion

Alternative investments like P2P lending and crowdfunding represent an exciting frontier for the modern investor. They offer unique benefits such as diversification, potentially higher returns, and the ability to align your money with your values. However, they also come with distinct risks that demand careful consideration and thorough research. By approaching these new channels with a clear strategy and a well-diversified approach, you can tap into innovative avenues for wealth creation.