Real estate has long been considered a cornerstone of wealth creation, offering potential for significant returns, passive income, and portfolio diversification. However, diving into property investment—whether it’s a flat or land—requires careful consideration and a keen eye on market dynamics. Before making such a significant commitment, understanding key factors and future trends is crucial.

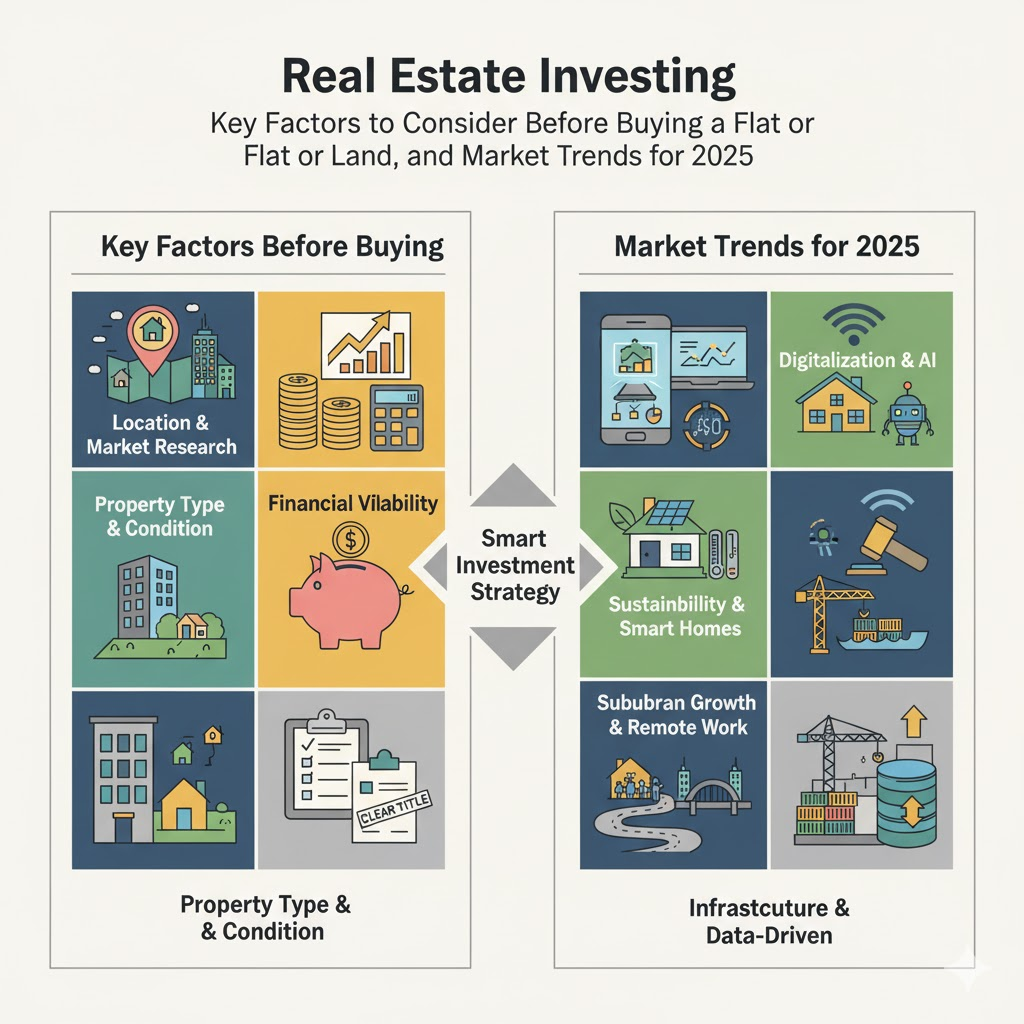

Key Factors to Consider Before Buying Real Estate

Whether you’re looking at a residential flat for rental income or a plot of land for future development, these factors are paramount:

1. Location, Location, Location

This age-old mantra remains true. A prime location dictates:

- Appreciation Potential: Areas with strong economic growth, job opportunities, and desirable amenities tend to see faster property value increases.

- Rental Demand: For flats, a good location ensures a steady stream of tenants, reducing vacancy periods. Proximity to schools, hospitals, public transport, and commercial hubs is vital.

- Accessibility: Easy access to major roads, highways, and public transit links.

2. Market Research and Due Diligence

Don’t buy on emotion.

- Local Market Trends: Research average property prices, rental yields, vacancy rates, and recent sales in your target area.

- Future Development Plans: Are there any upcoming infrastructure projects (roads, metros, airports, commercial zones) that could boost property value? Conversely, are there any negative developments planned?

- Property History: For flats, check the building’s age, maintenance records, and any past issues. For land, verify its zoning, permissible uses, and environmental surveys.

3. Financial Viability and Funding

- Budget & Affordability: Determine how much you can realistically afford, factoring in the down payment, closing costs, property taxes, insurance, and potential renovation expenses.

- Financing Options: Explore mortgage rates, loan terms, and eligibility criteria from various lenders. Get pre-approved to understand your borrowing power.

- Return on Investment (ROI): Calculate potential rental income versus expenses (mortgage, taxes, maintenance) to estimate your cash flow and potential ROI. For land, consider holding costs (taxes) versus future sale price.

4. Property Type and Condition

- Flat (Apartment): Consider the number of bedrooms, amenities (gym, pool, security), building management quality, and homeowners’ association (HOA) fees. These fees can significantly impact your cash flow.

- Land: Understand the type of land (residential, commercial, agricultural), its topography, soil quality, access to utilities (water, electricity, sewage), and any easements or restrictions. Raw land might require substantial investment before it’s usable.

5. Legal and Regulatory Aspects

- Clear Title: Ensure the property has a clear and marketable title, free from any encumbrances or disputes.

- Local Laws & Zoning: Understand local zoning regulations, building codes, and any restrictions on renovation or development.

- Taxes: Research property taxes, capital gains tax, and any other levies associated with property ownership or sale.

Real Estate Market Trends for 2025

Looking ahead, several trends are likely to shape the real estate landscape:

- Continued Digitalization: Virtual tours, online closings, and AI-powered market analysis will become even more prevalent, streamlining the buying and selling process.

- Focus on Sustainability & Green Buildings: Properties with energy-efficient features, solar panels, and sustainable materials will command higher value and attract eco-conscious buyers/tenants.

- Suburban & Exurban Growth: The shift towards remote work will continue to drive demand for larger homes with dedicated workspaces in more affordable suburban or exurban areas, though urban centers will retain their appeal for certain demographics.

- Rise of Smart Homes: Integration of smart technology for security, climate control, and convenience will be a standard expectation, not a luxury.

- Interest Rate Volatility: While rates fluctuate, investors should prepare for potential shifts, which can impact affordability and borrowing costs.

- Affordable Housing Demand: Demand for affordable housing options will remain strong, potentially pushing investment into smaller units or areas with lower price points.

- Emerging Markets & Infrastructure-Led Growth: Areas benefiting from government infrastructure projects (new roads, ports, industrial corridors) will see accelerated property value growth.

- Data-Driven Investment: More investors will rely on big data and analytics to identify undervalued properties and optimize investment strategies.

Conclusion

Real estate investing offers exciting opportunities, but it’s a marathon, not a sprint. Thorough research, diligent financial planning, and an understanding of market trends are your best tools for making informed decisions and building a successful property portfolio. Approach each potential investment with a clear strategy and a long-term perspective.