Gone are the days when budgeting meant meticulously tracking every single penny in a physical ledger. Today’s fast-paced, digital world demands budgeting methods that are simple, flexible, and effective – especially for a generation that values convenience and instant insights.

If you’re looking to gain control over your finances without feeling restricted, these modern budgeting techniques are for you.

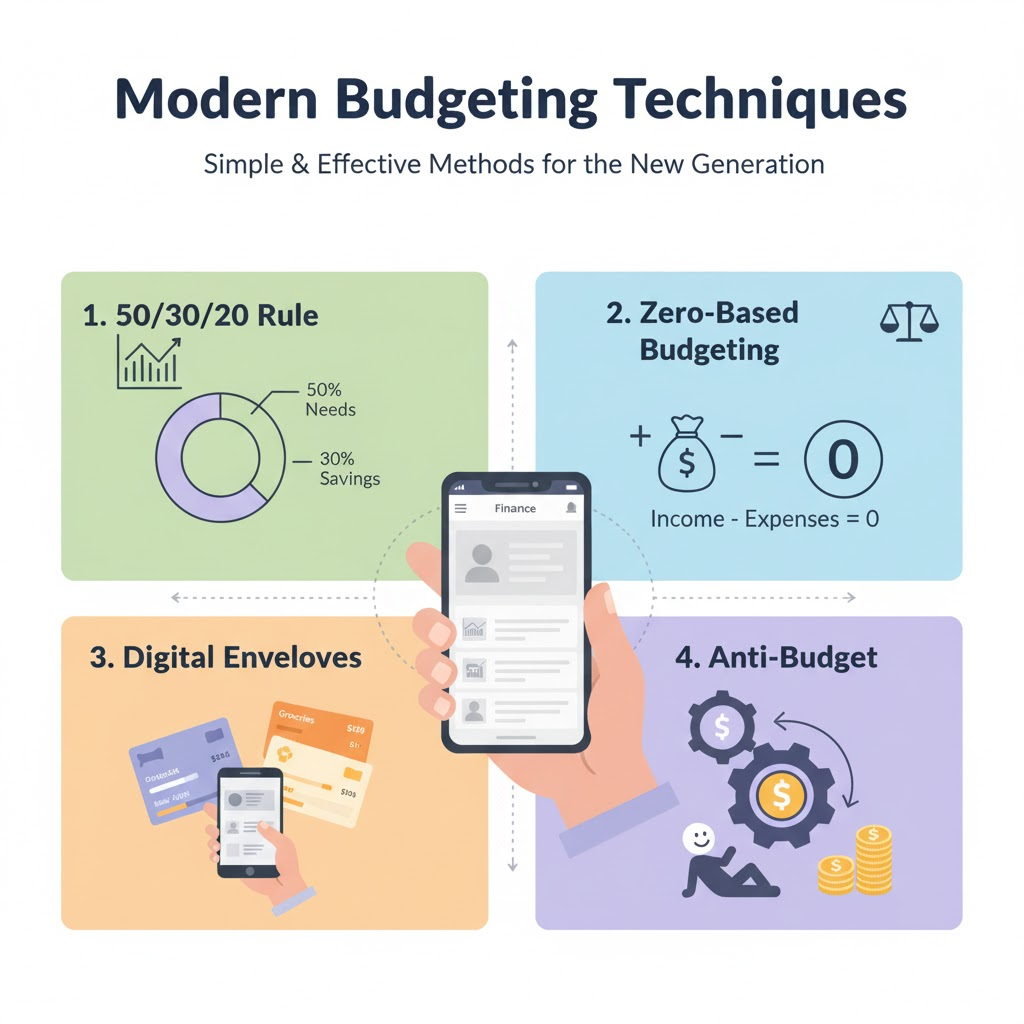

1. The 50/30/20 Rule: Simplicity is Key

This is perhaps the most popular and straightforward budgeting guideline, ideal for beginners. It categorizes your after-tax income into three main buckets:

- 50% for Needs: Essential expenses you can’t live without. This includes housing (rent/mortgage), utilities, groceries, transportation, insurance, and minimum loan payments.

- 30% for Wants: Discretionary spending that enhances your lifestyle. This covers dining out, entertainment, hobbies, shopping, vacations, and subscriptions.

- 20% for Savings & Debt Repayment: Financial goals like building an emergency fund, retirement contributions, investing, and paying down high-interest debt beyond the minimum.

Why it works: It’s flexible and doesn’t require obsessive tracking of every small expense. You just need to ensure your major spending categories align with these percentages.

2. Zero-Based Budgeting: Every Dollar Has a Job

Inspired by corporate budgeting, this method ensures that every dollar of your income is assigned a specific purpose before the month begins. Your income minus your expenses (including savings and debt payments) should equal zero.

How it works:

- List your total monthly income.

- Allocate every dollar to a category: rent, groceries, utilities, savings, debt payments, entertainment, etc.

- Adjust until your income minus all allocations equals zero.

Why it works: It prevents “mystery money” from disappearing and forces you to be intentional with every penny. This method is highly effective for breaking bad spending habits and accelerating financial goals. Tools like YNAB (You Need A Budget) are built around this principle.

3. Envelope Budgeting (Digital Style): Visualizing Your Spending Limits

The traditional envelope system involved putting cash into physical envelopes for different spending categories. The modern version leverages technology to achieve the same visual allocation of funds.

How it works:

- Identify your spending categories (e.g., Groceries, Dining Out, Fun Money).

- Allocate a specific amount to each “envelope” (or digital category in an app).

- As you spend, deduct from the relevant envelope. Once an envelope is empty, you stop spending in that category for the month.

Why it works: It provides a clear, visual representation of how much money you have left in each category, preventing overspending. Many budgeting apps like Goodbudget offer digital envelope systems.

4. The Anti-Budget: For Minimalists and Busy Bees

If traditional budgeting feels too restrictive or time-consuming, the Anti-Budget might be for you. It’s incredibly simple and focuses on automating your financial priorities.

How it works:

- Decide on your savings rate (e.g., 20% of your income).

- Automate transfers for savings, investments, and debt payments to occur immediately after you get paid.

- Spend the rest guilt-free.

Why it works: It prioritizes your financial goals first. Once your savings and debt payments are handled, you have complete freedom with the remaining money, reducing stress and the need for constant tracking.

5. Automated Budgeting with Apps: Your Digital Financial Assistant

Modern budgeting is made infinitely easier with technology. Budgeting apps integrate directly with your bank accounts, categorize transactions, and provide real-time insights.

Popular Apps:

- Mint: Free, tracks spending, categorizes transactions, sets budgets.

- Rocket Money (formerly Truebill): Identifies subscriptions, negotiates bills, tracks spending.

- YNAB (You Need A Budget): Excellent for zero-based budgeting, active management.

- Copilot Money: AI-powered, focuses on insights and trends.

Why it works: These apps automate the tedious parts of budgeting, providing a clear picture of your financial health without requiring manual data entry.

Choosing Your Method

The “best” budgeting method is the one you’ll stick with. Experiment with a few, see what aligns with your personality and financial goals, and remember that consistency is more important than perfection. Modern budgeting is about empowering you to make conscious financial choices, not about deprivation.