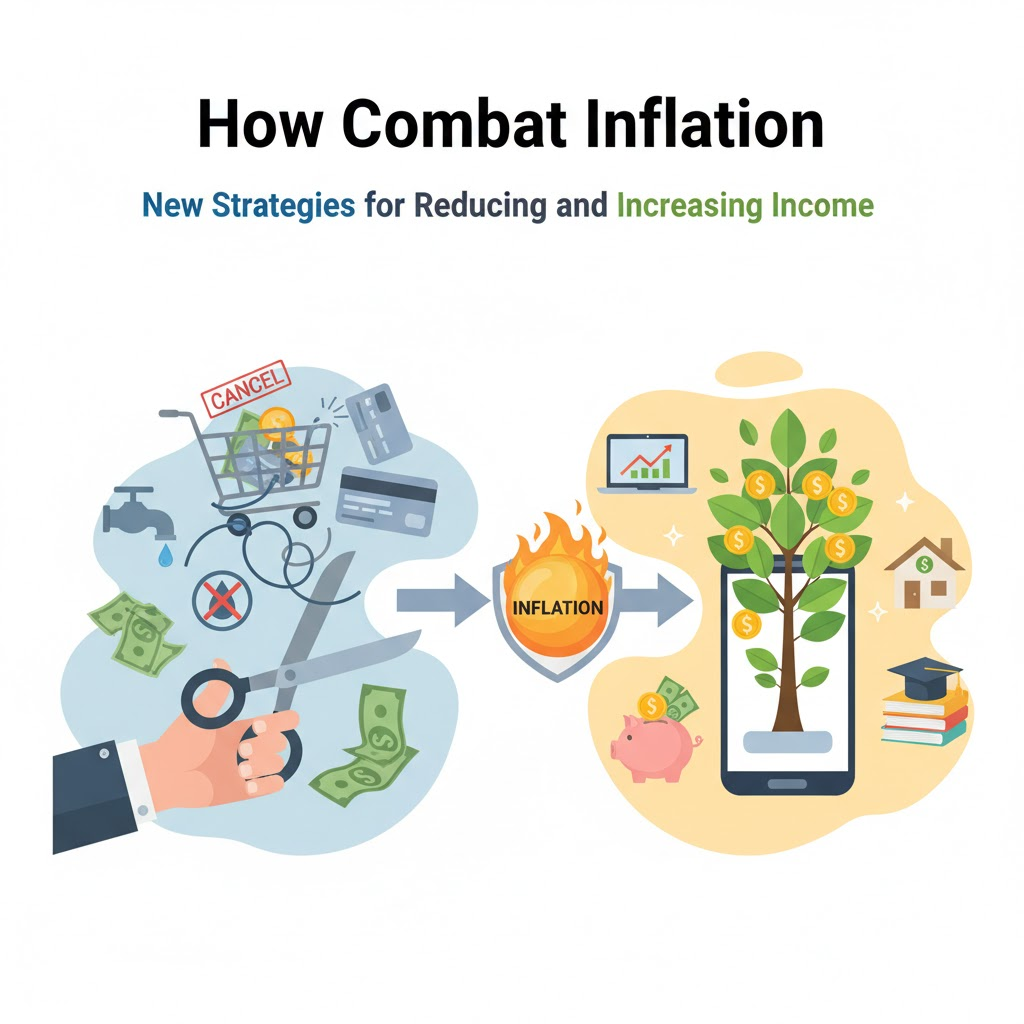

Inflation is one of the biggest economic challenges today. It erodes our purchasing power, makes everyday necessities more expensive, and shrinks our savings. While we can’t control the global economy, we can adopt new, effective strategies to reduce our expenses and increase our income to navigate this difficult climate.

1. Implement Next-Level Budgeting and Expense Reduction

Simply tracking expenses isn’t enough; we need smarter, more aggressive budgeting.

- Try Zero-Based Budgeting: This method ensures every single dollar of your income is allocated to a specific purpose (savings, bills, investment, or spending). When your budget equals your income, you eliminate “leaky” spending and gain full control over your money.

- The “Subscription Audit”: Take a hard look at recurring monthly costs like streaming services, app subscriptions, or gym memberships. Cancel anything you use infrequently. These small costs add up to significant annual savings.

- Embrace “Low-Cost” Entertainment: Swap expensive outings for budget-friendly alternatives. Host potlucks instead of dining out, use your local library for books and movies, or explore free local parks and events.

- Utility Efficiency: Install smart thermostats, switch to energy-efficient LED bulbs, and be mindful of electricity and water use. Reducing consumption is the most direct way to lower skyrocketing utility bills.

- Negotiate Everything: Don’t accept the first price for phone plans, internet, or insurance. Call your providers, mention a competitor’s offer, and ask for a better rate or package. A few minutes on the phone can save hundreds per year.

2. Generate New Income Streams (The “Side-Hustle Stack”)

To truly get ahead of inflation, you must increase your income. Relying solely on a salary increase often isn’t enough.

- Monetize Existing Skills: Use platforms like Upwork or Fiverr to offer services like freelance writing, graphic design, virtual assistance, or social media management. Your skills are in demand globally.

- Become a Knowledge Broker: Offer online tutoring or create and sell a digital course (on platforms like Teachable or Udemy) based on a skill you have, whether it’s coding, language, or even baking.

- Rethink Your Assets: If you have an extra room, consider renting it out short-term on Airbnb. If you have specialized tools or equipment (like a high-end camera or woodworking tools), rent them out to others.

- Resale and Flipping: Use apps like Poshmark or local marketplace groups to sell unused clothing, electronics, and furniture. This not only declutters your home but provides immediate, tax-free income.

3. Master Food and Grocery Cost Management

Food prices are a major driver of inflation. Strategic planning here is critical.

- Meal Planning is Mandatory: Plan out all meals for the week before going shopping. This stops impulse buys and ensures you only purchase what you need.

- Shop the Perimeter and Buy in Bulk (Wisely): Grocery stores put the freshest, cheapest items (produce, dairy, meat) around the store’s edge. Focus your shopping there. Buy non-perishable staples (rice, pasta, frozen veggies) in bulk only if you know you will use them.

- Cook at Home & Pack Lunch: This is the single most effective strategy. A packed lunch costs a fraction of buying takeout or dining out, and batch-cooking meals on the weekend saves both time and money during the week.

- Reduce Food Waste: Learn to properly store produce and creatively use leftovers (e.g., turning leftover chicken into a soup or salad). Reducing waste is the same as increasing your grocery budget.

4. Prioritize Debt Reduction and Smart Investing

High-interest debt is a hidden inflation factor—the interest rate compounds your financial stress.

- Attack High-Interest Debt: Use the Debt Avalanche method (pay off the debt with the highest interest rate first) to minimize the total amount of interest you pay over time. Freeing up these monthly payments acts like an immediate raise.

- Inflation-Hedged Investments: Consult a financial advisor about diversifying your portfolio. While not risk-free, investments like real estate, commodities, or inflation-protected securities can potentially offer a better return than cash sitting idle in a low-interest savings account.

- Review Insurance Policies: Shop around for better rates on car, home, and health insurance. Don’t be afraid to switch providers—loyalty rarely pays when it comes to insurance.

By combining rigorous expense management with a proactive approach to generating extra income, you can build a strong financial foundation that not only withstands the pressure of inflation but also sets you up for long-term financial security.